Inflation will continue to ebb and flow, but the likelihood of a return to an “old-world” or pre-pandemic financial situation is slim, especially in the near term.

As consumers, we already acutely feel the impact of inflation on our daily lives. As business leaders, rising costs necessitate changes to how we procure the components of our services and the price put on the end product.

Companies continue to review operational policies and procedures, searching for ways to reduce loss and keep a profit margin. However, today, these steps alone are an incomplete solution. Instead, conversations between partners should include all avenues of maintaining the best quality service provisions for assignees, including increased fees.

Pricing is not just a tricky conversation. Accurately and fairly calculating where and how much to increase is a complex operation. In addition, pricing must consider a bit of the unknown, how long will inflation last, and how high will it go? An excellent place to start is by examining the percentage that costs have risen for the inputs that make up a service or product.

Pricing is not just a tricky conversation. Accurately and fairly calculating where and how much to increase is a complex operation. In addition, pricing must consider a bit of the unknown, how long will inflation last, and how high will it go? An excellent place to start is by examining the percentage that costs have risen for the inputs that make up a service or product.

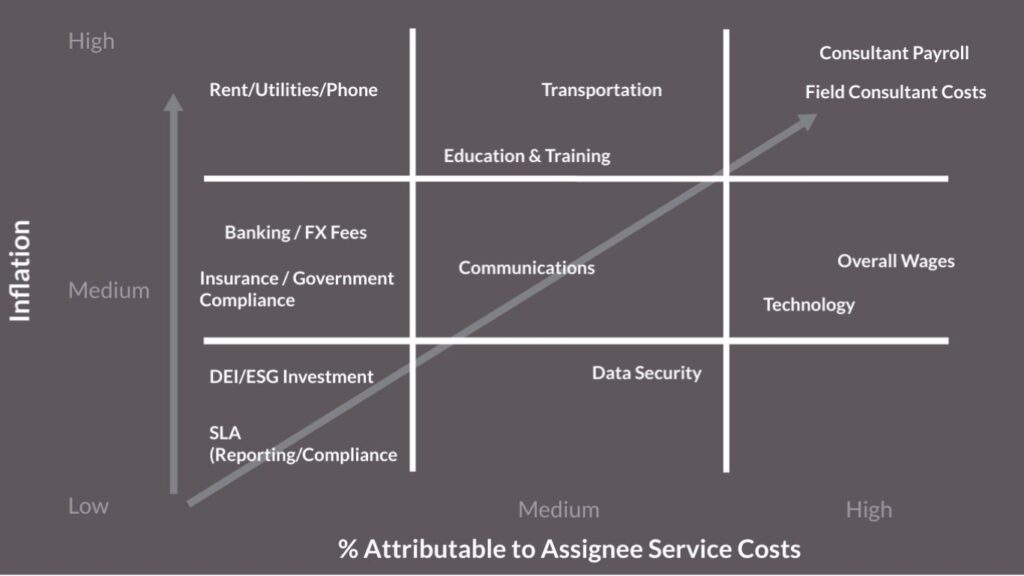

From the assignee-impact perspective, there are inflationary impacts that vary by degree. Using an exposure matrix can help companies identify where their most critical costs are and where expenses may be trimmed without significantly affecting the end product. Exposure Matrices also provide insight into how inflation impacts a product or service. If the cost for meals is rising by 4%, but a product or service doesn’t include a meal, then using a 4% inflation rate to request a pricing increase is not applicable. When raising prices on chicken breasts per our previous example, the cost of corn, transportation, and talent should rank high for inflation and impact on the product. Other costs contribute to but have a varying degree of effect on the shelf price at the grocery store. Inflation in the areas of clothing or housing has minimal impact on the price of chicken and would make poor reasoning for an increase.

An exposure matrix for our company would look like this:

Our costs to deliver client reports and other required compliance components of our contract Service Level Agreements (SLA) have not been significantly impacted by inflation, and the costs are shared across all services the company performs. However, the Relo Specialist Team payroll costs have been substantially affected by inflation and the talent shortage and are highly attributable to assignee service costs. Hence, our internal conversations around profit margins and pricing will take the RS Team payroll, overall wages, and technology into greater consideration than Insurance / Government Compliance.

As the cost of mobility, especially cross-border moves, increases, so does business pressure on total rewards and talent mobility professionals to identify cost reduction. So what do the standard cost-reduction techniques of decreasing in size and quality, unbundling, and ending discounts look like in a global relocation policy? It looks like fewer assignee benefits at a time when relocating employees face increased challenges and the war for talent demands an excellent assignee/employee experience.

We are all facing the same dilemma: controlling costs while maintaining and improving the employee relocation and assignment experience.

As mobility teams make plans for 2023, we strongly encourage them to create their exposure matrix, review those of their supplier teams and use them to drive understanding with internal stakeholders.